Cue the eye-rolls. Yep, it’s another crypto article from some dude on the internet. This one is a bit more geared to the creative industry, creative entrepreneurs, and digital content creation, however.

I want to share the technical knowledge I’ve gained over the past year and explore some possibilities into how these emerging technologies will affect how digital content is created, streamed, and monetized in these strange, exciting times.

There will be no Crypto-Bro speak, no 🚀🚀🚀 emoji’s, and no theses on coin speculation. I just want to focus on the technological aspect of what crypto (and the blockchain) can offer and how it can help digital media continue to grow.

We’re going deep into the murky waters. Stick with me.

(If you want the TL;DR, hop to the last section)

Let’s quickly summarize what crypto is because it gets confusing for the less than technically-savvy. If you are already familiar, hop over to the next section.

Cryptocurrency first emerged in Bitcoin around 2009 and aimed to replace traditional currencies decentralized from any government.

Since then, thousands of cryptocurrencies exist with Bitcoin and Ethereum at the forefront. Their technology is based on a blockchain.

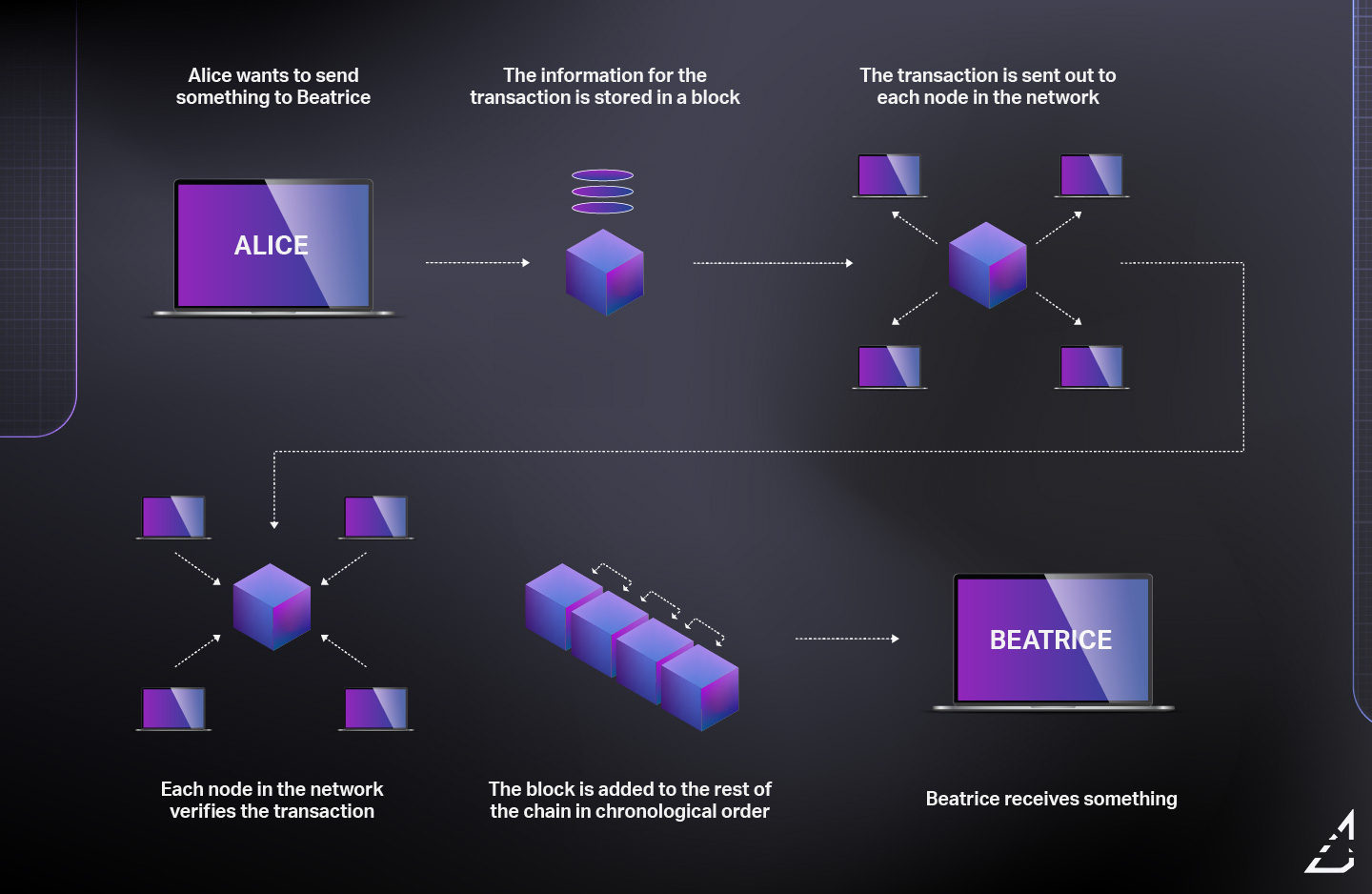

Think of the blockchain as a giant database that keeps a ledger of every transaction starting from the beginning. The ledger is public, but each “block” needs to be verified by many different computers to ensure that each record matches accurately.

Blockchains store data in the individual blocks chained together in chronological order to make up the global ledger. Transactions that enter the blockchain are permanently recorded and publicly viewable.

From a security standpoint, the blockchain is a safer way to store information because a single node cannot alter the records. Other nodes cross-reference each other and can self-correct if there are any inconsistencies in the data.

Here’s a practical example:

Maria is 35 years old. Bob and John are good friends of Maria’s and celebrate her birthday every year. They have also seen her Birth Certificate and can verify her age. (ok, that’s strange, but give me a break here).

Well, Betty is going around town and telling people that they should know that Maria is 40 years old. A blatant lie! Betty has incorrect data. Maria, Bob, and John can verify that she is indeed 35 years old from looking at her birth certificate.

Betty stands corrected, and the rest of the town is informed of the correct information. Maria‘s age is written in the town newspaper with a timestamp that everyone has reached a consensus that Maria is 35 years old.

Aside from Maria’s loss of privacy, this is essentially what the workers in a blockchain spend CPU resources doing — reaching a common consensus about a transaction. The block is filled with data and given a timestamp that someone cannot easily alter.

Blockchain technology isn’t restricted just to cryptocurrencies as it has been implemented in many other use-cases such as Cyber Security, Healthcare, and Supply Chains. It is useful in preventing human errors when validating data.

You’re a kid again, and your family brings you to your favorite arcade. You pay up ten bucks worth of allowance, and in return, the attendant gives you a cup full of coins.

Now inside the arcade, you are rolling in dough. You can play anything you want as long as you still have coins. If you leave the arcade, however, those coins are meaningless.

You have the choice to either sell your remaining coins to a friend who wants to continue playing, or you need to spend them.

This analogy basically describes what a Crypto Token is. Tokens are meant to be used in a specific ecosystem, where cryptocurrencies are meant to be used as a store of value or method of exchange for goods and services.

Currencies like USD, CAD, Bitcoin, and Ethereum get you in the door, but the tokens allow you to participate in the environment. Bear in mind that tokens can be exchanged back and forth with different currencies so long as they have value. This swap is done at Crypto Exchanges.

In this article, I want to focus on Crypto Tokens and the tokenization of digital commodities like video streams, art, and collectibles rather than currencies and economics.

Crypto has exploded over the past few years and has spawned many coins. The rapid adoption of DEFI (Decentralized Finance) during Covid Lockdowns pushed the space even further into becoming a viable financial option.

In some ways, coin and token growth can be attributed to an ever-expansive amount of possibilities with finance, Commerce, and entertainment applications.

Aside from any future legislation that may negatively affect crypto, the currencies also face internal problems. Bitcoin and Ethereum both need to address the “Blockchain Trilemma” to continue to grow into a fully functioning global currency.

The “Trilemma” consists of the following:

- The system must maintain decentralization without a single controlling entity.

- The system is scalable to handle increasing transactions on the blockchain.

- The system is secure for users and protection against bad actors.

Many different coins aim to solve these problems, but they must be addressed for all-encompassing adoption.

I keep telling my wife, “When 60-something-year-old Joe Schmo can reliably process blockchain transactions and doesn’t have to worry about losing all his investment or learning all the technical aspects, then we will see a massive shift in the trustworthiness of Crypto.”

Trust me; she’s heard it plenty of times.

So, I am not a finance guy or some tech guru. I am just a friendly neighborhood Creative Director who looks out for potential opportunities that allow me to continue doing what I love.

With that being said, do your research, don’t listen to any single person, and keep your mind open to opportunities while reading this. We are going through a massive cultural shift, and control in the future will be in the individual’s hands.

Video content is here to stay, and streaming is growing exponentially year over year.

You may have noticed this over the past year, but streaming platforms have throttled the default quality of videos once the pandemic hit.

Bracing for the increased bandwidth usage, streaming providers reduced video quality (as default, you would have to select higher quality manually) to lighten the payloads on Internet Service Providers (ISP’s).

As network payloads will continue to increase in the coming decades, it is becoming increasingly crucial for ISP’s to balance quality and delivery.

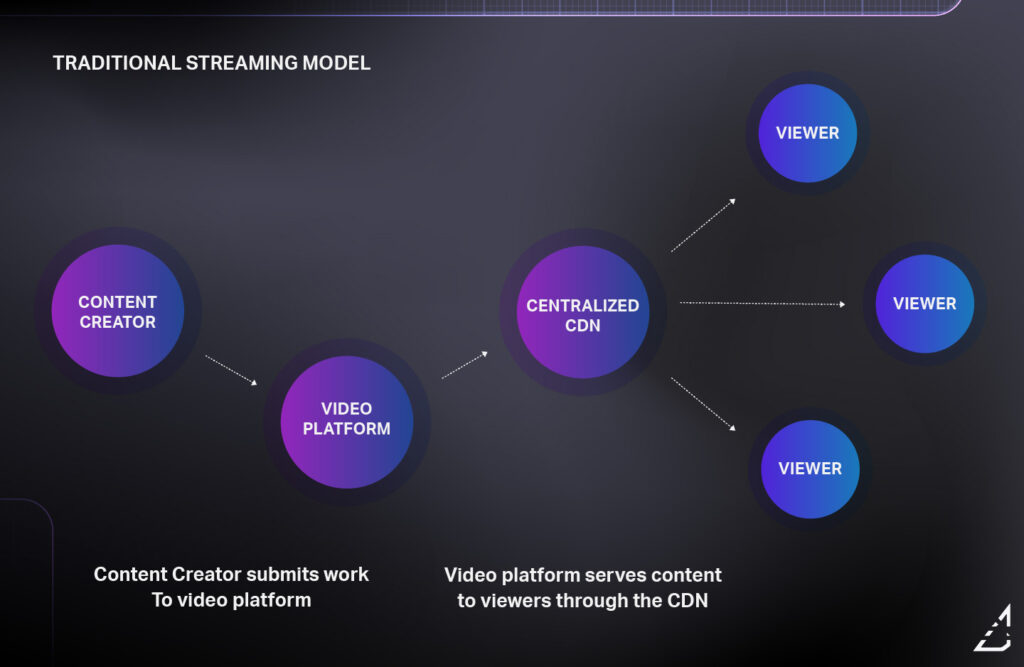

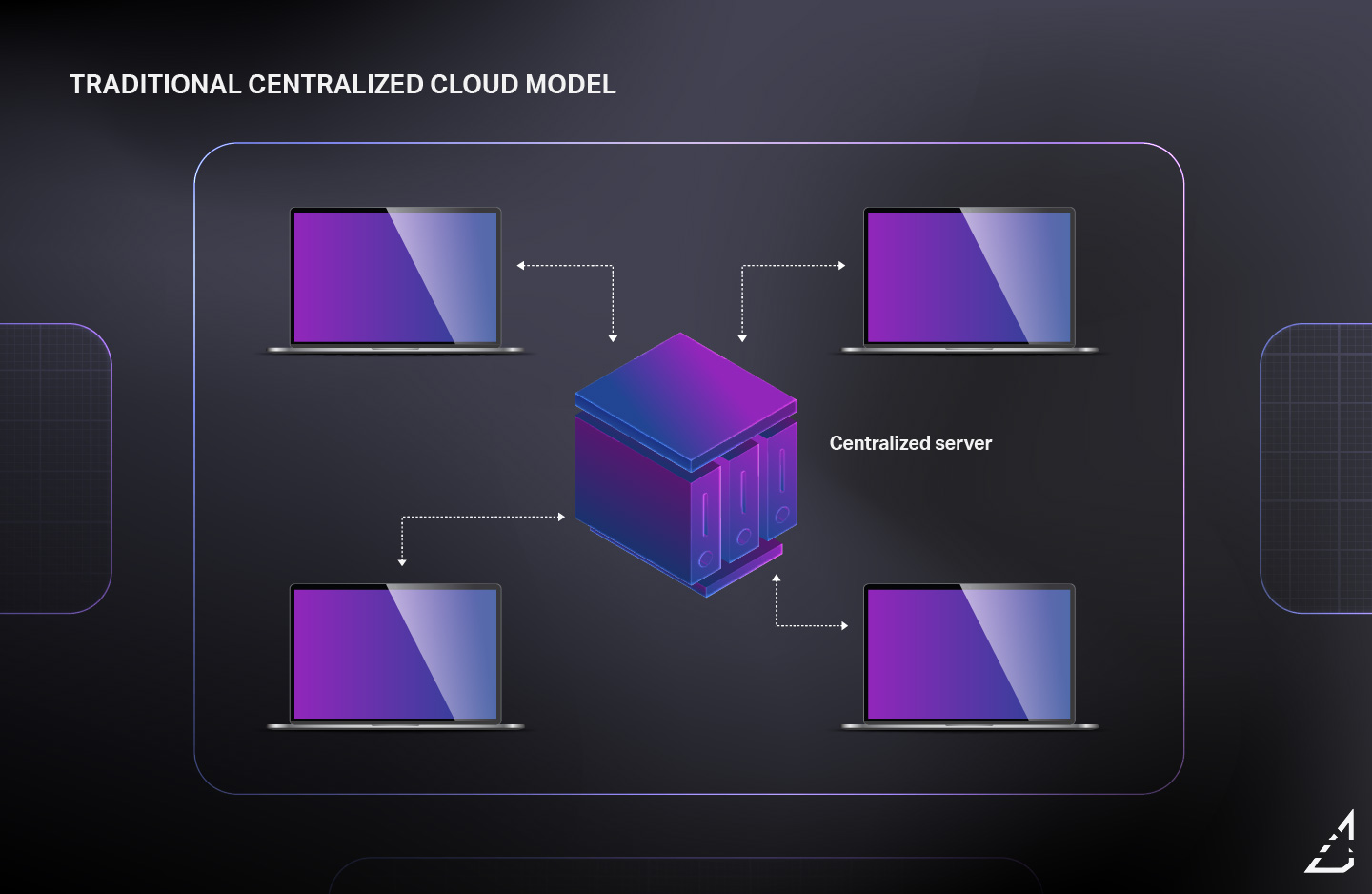

Streaming platforms rely on Content Delivery Networks (CDN’s) or Cloud Computing to deliver video to the end-user.

CDN’s were a great solution in the past but suffer from being exorbitantly expensive to host large-scale video content at the Enterprise level and still rely on centralized Data Centers in different regions around the world (POPs).

Cloud Computing Providers have been a little slow-moving in adopting blockchain technology, but Microsoft Azure and Amazon Web Services both utilize it in some forms. Unfortunately, it doesn’t solve the problem of providing a lower-cost solution to indie studios or startups.

As 4K, 8K, and VR videos continue to rise, so do the underlying infrastructure’s demands to deliver without buffering or high loading times. Video buffering is so 1998.

Enter Theta Token.

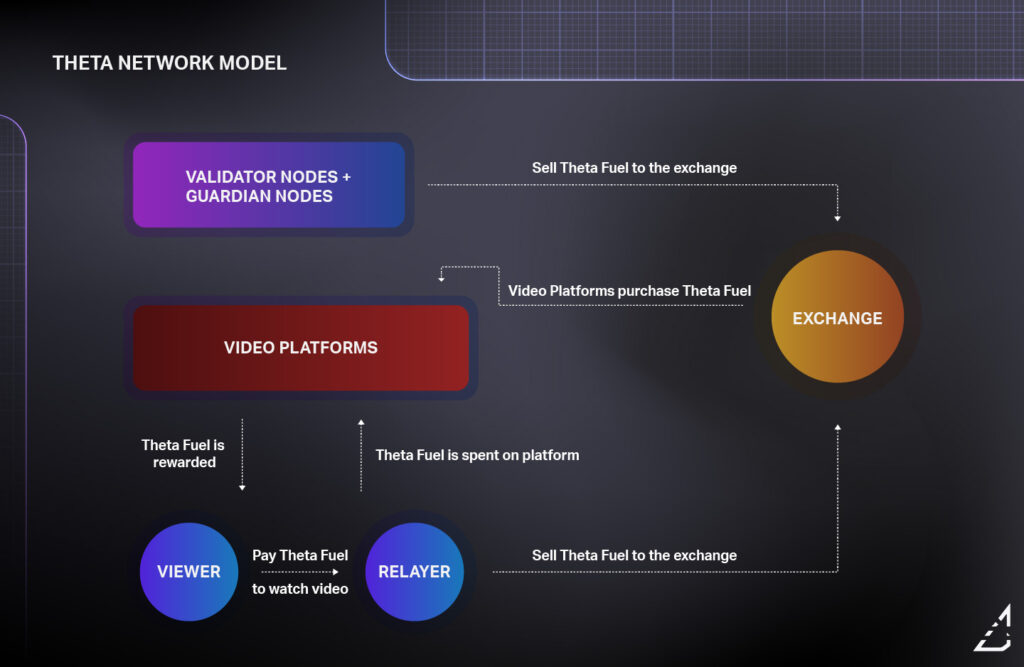

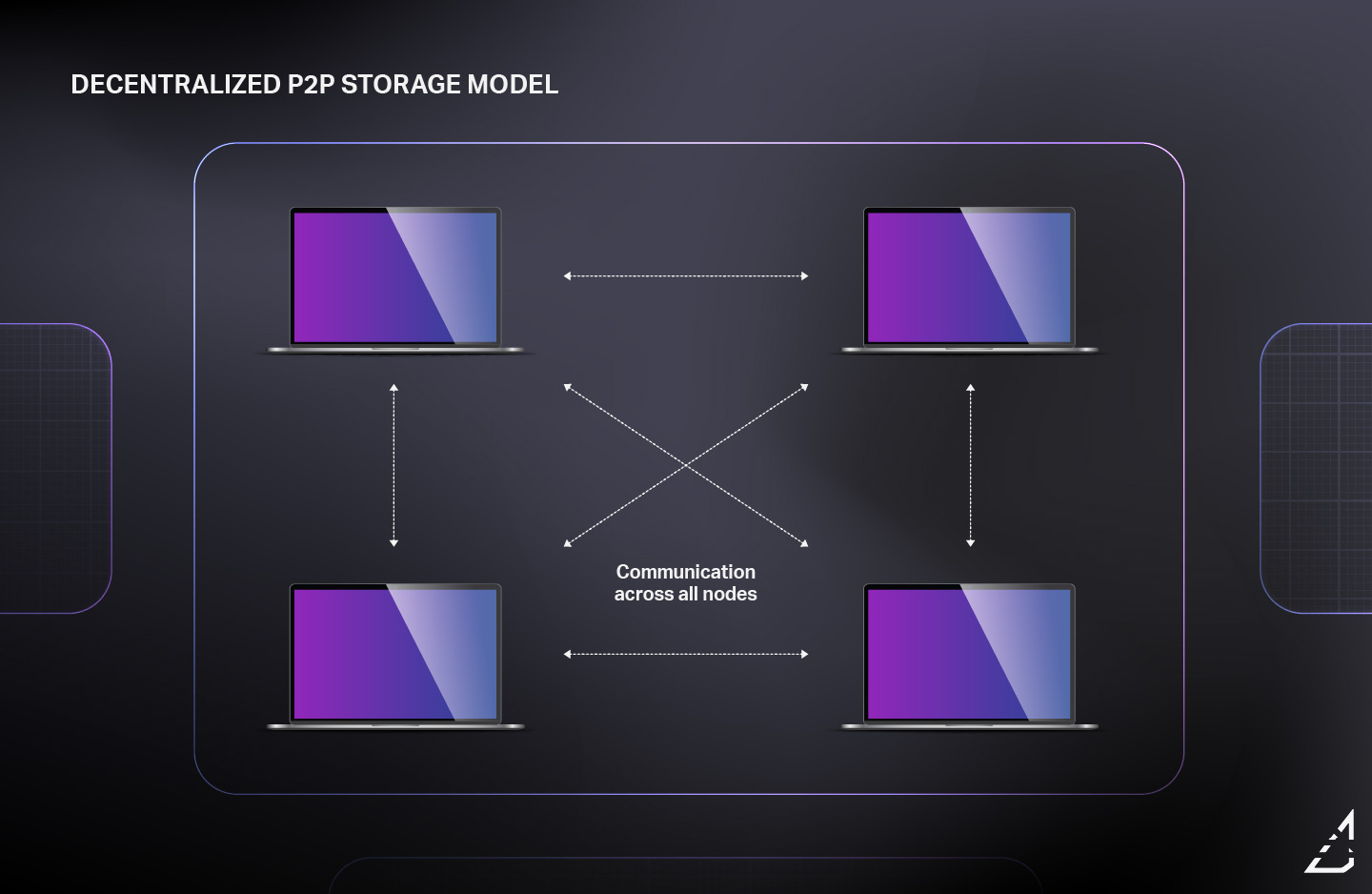

Theta Network aims to solve the problem of CDN’s by decentralizing content delivery using blockchain technology. Rather than having localized data centers, Theta uses a Peer-to-Peer (P2P) Network with individual nodes putting in the heavy lifting by caching and computing the video streams.

Think of how Kazaa, Limewire, and Napster worked but on mega blockchain steroids. Ok, bad analogy, but I want to illustrate how multiple computers talk to each other.

This P2P model results in less buffering or dropouts. An added benefit is that the network participants are rewarded in tokens which can be circulated through the ecosystem or converted to currency as payment.

Theta essentially rewards participants in the network for their shared bandwidth and resources. Fiat currency like USD is converted into their proprietary token used to fuel transactions between the Content Creators, Video Platforms, and Viewers. It functions as an incentive to partake in upholding the network.

This crowdsourcing model is becoming popular with other coins as well.

Being an open-source platform, Theta allows individual developers to build new apps on their network, thus extending the practical uses. This allows new businesses to develop their video platform on Theta’s infrastructure and not worry about content delivery or costs associated with traditional CDN’s or cloud computing.

An added plus is that more revenue is shared with the original creators of the content and the individuals who contribute the computing power of their machines to help cache and relay the video streams.

A big plus for the little guy/gal.

- High-Quality Streams without creating more points of failure in the system

- Opportunities for Premium or Gated Content through the use of the Theta tokens.

- Lower barrier to entry for startups seeking to develop a video content platform but can’t afford an Enterprise CDN or Cloud Computing.

- Opportunities for merchandising or cross-promotion through the exchange of the Theta Tokens.

- Alternative advertising models where viewers can receive tokens for watching ads.

- Video streamers are paid by viewers and can help shape the content in demand.

I think the ability to piggyback off Theta Network and create a subscription service to premium content and provide products like collectibles (digital or physical) could prove to be an all-in-one entertainment hub for viewers.

Picture this:

Everyone has Netflix. Everyone who has kids watch Netflix Kids. Imagine if Netflix had a way of allowing the kids to purchase their favorite characters as a collectible digital card to trade with their friends. All inside one app without having to whip out a credit card.

It is possible to even without Theta, but incorporating a token system can boost user experience.

If Fortnite history has told us anything, people will spend gobs of money for intangible goods if their perception is that of a rare commodity.

The current price of Theta Tokens is volatile.

For the tokenomics to work effectively, the TFuel tokens’ price (Think of it as gas for the network to operate) needs to stabilize. If you choose to use your rewards to pay for content or merch and the price fluctuates heavily, it would encourage people to hoard their tokens rather than exchanging them on the network for fear that they might not be getting a good “deal.”

Not to mention, if the incentives aren’t delivering as promised, content creators may move their content elsewhere.

If incentivization is the main play to attract people to the network, they will have to ensure that it remains balanced and fair despite any price fluctuation from speculators.

Theta Network has some big competitors.

Theta Network could become a direct competitor rather than a partner for big players like Youtube, Vimeo, and Twitch.

David vs. Goliath comes up as an analogy, but you may run out of rocks to throw when you have too many Goliaths that you are up against.

Despite how good the network sounds in theory, Theta will need to continue pursuing partnerships to carve out its niche.

It’s no secret that digital content takes up a tremendous amount of space. As I write this, behind me is a cabinet full of old hard drives storing video, graphics, photos, and 3D renders.

Oh, hey, Storj!

Storj is a decentralized cloud storage network that relies on individuals to share unused storage and bandwidth on their computers. It is still early on in the project, but they aim to create a next-generation file storage system that is faster, cheaper, and more reliable than any current solution on the market today.

- Faster transfer speeds

- Potentially 10-100x cheaper than current online file storage providers

- Very low risk of data loss

The Future of Cloud Storage

Currently, you have many options for storing your files online — Dropbox, Google Drive, and Box, to name a few. But as content creators and artists know, it sometimes is impractical to store working projects on the cloud due to size and speed limitations.

A cheaper alternative

Video projects can take up terabytes of space, and the tiered plans from these companies get expensive fast, and you often pay for space that you aren’t using because you have to store larger projects on external hard drives or raid arrays.

Since the Storj Network doesn’t use any data centers and by their estimation, the service could slash costs 10-100x from current cloud storage providers. Additionally, you wouldn’t have to pay for unused space.

Secure and Private

I’d love to store sensitive documents in Dropbox, but I don’t entirely trust that it is totally secure.

As we have seen in the past, there have been exploits targeting Google and Dropbox.

Dropbox can improve their encryption for files at rest, whereas Google needs to strengthen its encryption for transferring files. Neither offers iron-clad, end-to-end encryption at the moment.

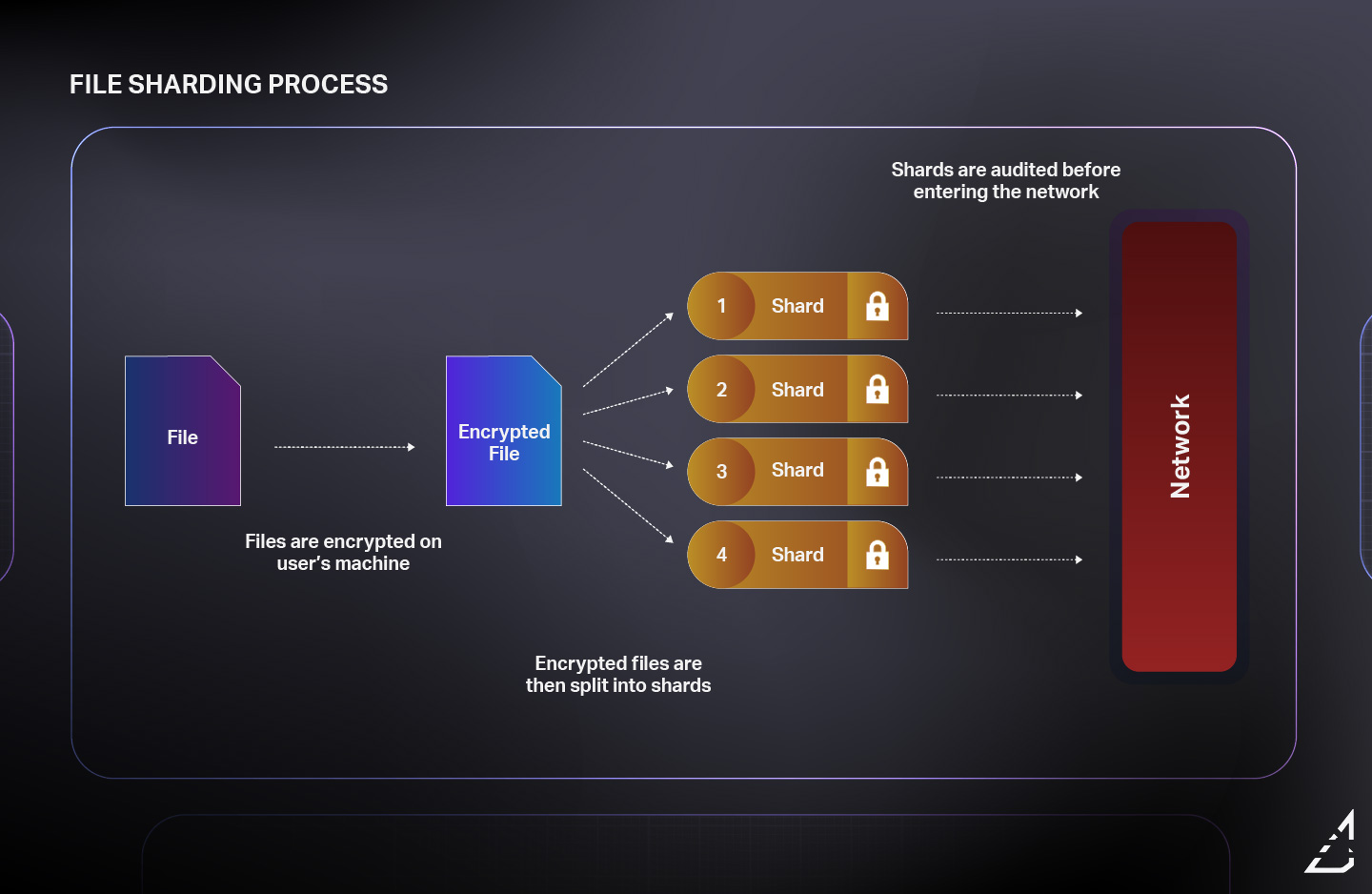

Because files have end-to-end encryption, the Storj network is more secure than services like Dropbox. Additionally, each file is split into 80 different pieces, with 29 of those necessary to re-assemble the encrypted file. Each computer that is contributing hard drive space to the network cannot see complete files.

Super Fast

With Storj, people’s internet connections are the only bottleneck in the P2P network. Files transfers aren’t limited by a centralized infrastructure’s (Dropbox, GDrive, Box) speeds. Soon, when Gigabit transfer speeds are more common, this will only bolster up the Storj network even more.

This is entirely different from the current providers in which the files are stored on physical servers. Because each participant on the network is receiving fragments of files, it is much faster to serve kilobytes of data rather than megabytes and gigabytes at a single time.

Legal Grey Area

For those familiar with the technology, it is plain to see that the individual contributors of the Storj Network aren’t able to see what kind of files they are hosting. Everything is fragmented and encrypted.

But how clear will it be to Lawmakers trying to prevent illegal or harmful material from being distributed throughout the web?

The question I have is, can individual nodes be held responsible for bad actors in the network, or will they be protected as a Safe Harbor like other tech companies?

Let’s look at it this way:

If you own a storage facility, should you be held liable if one of your tenants is storing drugs in their unit? How do you maintain a safe environment without infringing on people’s privacy?

Also, how do you prosecute offenders if you don’t know where to look?

Decentralization, at its core, is very troublesome to authorities. Future legislation will need to be implemented carefully to ensure that technology continues to grow but not detrimental to people’s safety.

Another question is will a decentralized storage network encourage the distribution of illegal material on the internet, or can the argument be made that it will exist regardless of measures put in place?

I was considering sharing some of my hard drive space with the network, but I would like to see how this issue is addressed before doing so.

Man, do I love me some Brave Browser.

It looks like Chrome. It feels like Chrome. Heck, it’s built on Chromium. But it comes with a bunch of privacy features that just work out of the box.

So, Brave is pretty unique. They made this browser to ensure people’s privacy is respected and to try and fix the broken monopoly that is Digital Advertising.

Right now, we face privacy issues. I’m sure that you are familiar with the Facebook ad that conveniently pops up right after you searched for something on Amazon. This is called Remarketing.

Every time you google something, what takes up the first five listings? Yep, you guessed it. Ads.

Granted, Facebook, Google, and other platforms make most of their revenue from ad sales, so it shouldn’t come as much of a surprise. But we should have options.

Mainstream ad platforms are invasive, and despite all the data mining that they do, it never truly hits the mark by giving the user a choice on what they would like to see.

The Brave Browser is trying to fix that in two ways:

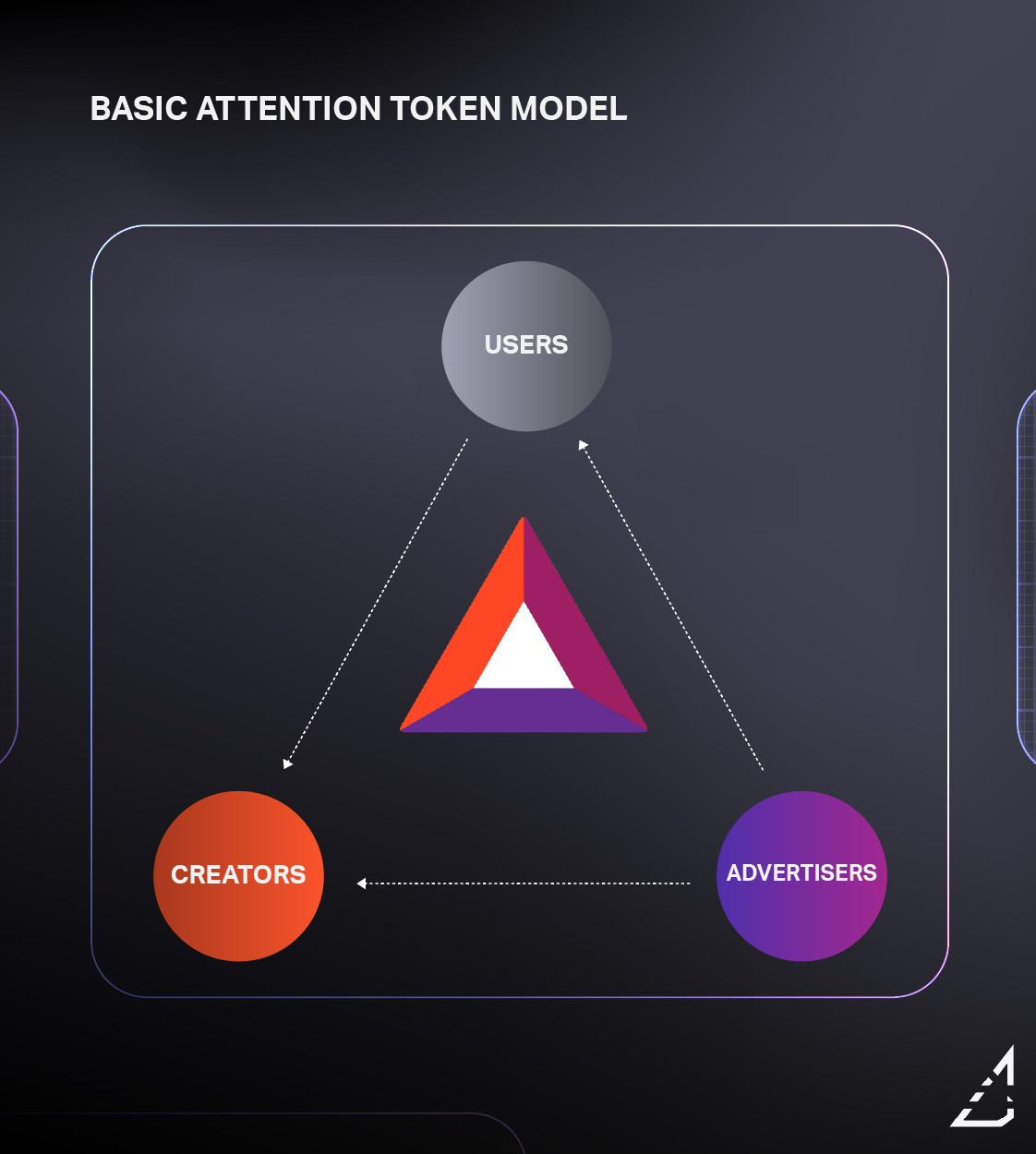

- A tipping system using their token (BAT – Basic Attention Token)

- Users are awarded for allowing ad popups

The tipping system is pretty neat. It encourages users to “tip” their favorite content creators. This can take the form of blogs, video content, Reddit posts, and more. Heck, I even implemented it into our site so that visitors can give us a little hat tip if they like what we are doing.

The whole tipping system wouldn’t function without injecting BAT into the ecosystem. This is where advertising comes into play. Advertisers purchase ad space using BAT, and it is rewarded to users that have ads enabled. Users would then spend their BAT tipping creators for their contributions to the web.

It almost sounds too idealistic, but I’ll ask you this. How many bloggers you know can monetize their writing without having to resort to gimmicks? How many YouTubers create free content for years hoping that one day they will have enough visitors to earn a living on it?

Brave is providing another outlet for Creative Entrepreneurs to share their work and get rewarded for it. Will it make you rich? Maybe not, but it positively contributes to a level playing field wherein creators have options.

- Monetization across multiple media channels and websites

- A loyal audience who engage in tipping for content they like

- A new approach to digital advertising that can produce warmer leads

Tipping

As long as a website, Youtube, or Vimeo channel is registered, content creators can receive tips from fans. This allows greater freedom where you don’t have to be tethered to a specific platform to earn rewards.

Crypto wallet functionality is built right into the browser, so users can tip without taking out a credit card or going through a signup process where their data could be abused.

The whole system is anonymous and gives control solely to the user.

Unique Ad Platform

Brave’s browser could be an excellent option for small businesses to advertise themselves. Typical ad platforms like Google Ads and Facebook Business can feel unnecessarily complicated for someone who runs a small studio or agency.

To get the most out of them, you would typically need to hire out or have an in-house marketing lead who understands the marketing side and the development side. Facebook Pixel and Google Tag Manager aren’t for the faint of heart.

Very powerful when used to their full capabilities, but that also comes at a high cost. This isn’t always feasible for smaller companies.

Since Brave values privacy, I would wager that any leads you receive from a Brave campaign would be naturally warmer because they are being served ads that they want to see, and they chose to see them. (Users can go into their ad history and select categories of previous ads that they like)

Not to mention that since Brave uses Push notifications on mobile and desktop, users would be more likely to click the ad, especially since they are allowing the ads to be shown.

It’s a ballsy move going up against Google

Though it is one that I support, it will be tough for Brave to carve out a big chunk of market share from Chrome. There is big money being passed around, and I doubt Google would be content sharing the market.

I think Brave’s ace-in-the-hole is that they are supporting the little guy. I hope that they continue to nurture the culture around the browser and establish their niche.

BAT tokens are volatile right now

As I mentioned earlier, it is tough to use their token as a commodity when the price fluctuates every day. Though some people are using the token as they’re intended, many people are hoarding their BAT in the hopes that the value skyrockets.

Ad Platform is still in its infancy

Well, kinda. At the moment, Brave Ads is not a self-serve platform like other CPC services. To sign up as an advertiser, you have to contact them manually and go through an application process.

Additionally, they are only accepting campaigns with a minimum ad spend of $10,000 for 30 days. It’s not the most expensive thing in the world, but then again, it certainly isn’t spending $250 for a boosted Instagram post.

If Brave’s Clickthrough Rates (CTR) are as good as they say, it might be worth trying Brave Advertising out. Still, it will be quite a while before smaller businesses can justify advertising with them at the currently available options.

There has been quite a buzz on Twitter lately about NFT’s (Non-Fungible Tokens) and Crypto Art. Some well-known Motion Designers are making a killing selling the art they create but haven’t had a good monetization outlet in the digital artspace before this.

Most people I know just create for the sake of creating and then post on Instagram.

Unfortunately, you are at the mercy of Instagram for exposure.

However, marketplaces like Opensea.io, Superrare.co, and NiftyGateway are changing that.

Many people aren’t able to see Crypto Art’s value yet, but as a digital artist, there hasn’t been a solution to people assigning value to digital artworks before this.

Anybody can right-click and save an image, so how can provenance be established so that the original creator/owner is credited/paid?

Welcome to the wild west of Crypto Art.

For Digital Art to become Crypto Art, it must be first “minted” on the blockchain. The minting process is essentially creating a chain of custody from the original creator to any subsequent art token owners.

The media file, be it a graphic, photo, or video, is uploaded along with some necessary information from the owner verifying ownership. There is no tangible asset with Crypto Art (unless the owner prints it out and sends it to the buyer), but it serves as proof of ownership.

Think of it like this:

You are twelve years old again, and you have a rare pokemon card collection (Hello fellow Gen-Y’ers). You go to your local gathering place to trade cards, and someone steals a Charizard Hologram Card from you.

How do you prove that A) they stole it, and B) you owned it in the first place?

Here’s another example:

Let’s say that you go to your local art gallery and because you are awesome and support the arts; you would like to purchase this coveted Basquiat painting. Well, the gallery is relatively new, and you aren’t sure if you can trust them. They also don’t have any paperwork linking Basquiat to the actual painting.

How do you know if it is counterfeit? Do you take their word for it?

Verifying art on the blockchain solves both of these problems since all transactions are visible on a public ledger. Anyone can check to see who the original owner was.

- NFT’s provide a way for an artist to create collectibles from digital art they create

- Artists can monetize their digital art

- Crypto Art has a direct chain of ownership. Easy to prove.

Low Barrier to Entry

As long as you have a crypto wallet and some artwork, you can start selling NFTs. Many marketplaces are popping up day after day.

Not only is it prudent to verify artwork on the blockchain, but it is also an excellent avenue for exposure. Collectors and speculators alike scour the marketplaces for rare artworks that can fetch thousands of dollars.

Resale value

One of the nice things about Crypto Art is that digital artists can make a small percentage royalty if the token is resold.

Try getting that at a traditional art gallery.

A growing community of Crypto Art collectors buy and sell based on the art token’s perceived value.

Copyright Reinforcement and Licensing Agreements

Because there is a clear view of the token’s history, it is relatively easy to prove a chain of ownership and proof of creation. The timestamped records in the ledger could prove valuable in the future when providing evidence that an art piece existed at a particular time. All of the transactions are listed on the token’s history with the respective wallets it ends up in.

Another protection for digital content creators comes from the use of “smart contracts.” Though these contracts are all the rage in the De-Fi space, smart contracts ensure that licensing agreements between both parties are respected, and terms are appropriately managed.

Taking that a step further, smart contracts can also function as an escrow account where cryptocurrency is locked until all the terms are met.

High Gas Fees

Many crypto tokens used for trade are part of the Ethereum blockchain. As the Ethereum network gets congested processing transactions (~15 transactions per second), Ethereum Gas (GWEI) price goes up since the amount of work to process transactions increases. Miners who contribute their computational power to validate transactions are paid on these gas fees.

Right now, gas fees can range up to $200, even if it is a simple transaction. This doesn’t necessarily facilitate an active trading environment for those without big bucks.

Think of the high gas fees like the FastPass at Disney World. You pay extra to be able to skip the lines and enjoy the rides first. The cheapskates who didn’t opt for the first-class treatment have to wait in the slow lane while others move ahead.

Let’s use a car analogy.

You stop at the gas station with your Dodge Challenger Hellcat. It’s a gas guzzler, but you only have enough money to fill a quarter of the tank. There are two options here. Either you have to drive slowly to your destination to try to squeeze every last mile per gallon from it, or you need to pony up the cash to put in more fuel and get there faster.

One important thing to know, however, is because the Ethereum miners are putting in the effort of upholding the network, they can ignore transactions with a low gas limit.

Not exactly fair, I know.

Ethereum 2.0 will hopefully solve this problem as it can process up to 100,000 transactions per second, but we are roughly two years away from it being fully implemented.

For now, Crypto Artists will need to either select a time of day that is less likely to be busy, or they will need to increase the price of their artworks to include this fee. Kind of a bummer, but the Crypto Art market will only continue to grow as these issues get ironed out.

Value

This issue is subjective, but it affects Crypto Art in the same way that it affects traditional fine art.

You’ve always heard “Beauty is in the eye of the beholder”, and so is a price tag. Because there is no exchange of tangible goods, some people have a hard time justifying a purchase for the “right” to a digital collectible.

Many purveyors of Crypto Art don’t seem to have this problem. Still, to reach mainstream acceptance, the Crypto Art marketplaces will need to do a good job communicating to the uninitiated what exactly they are buying.

I think we are on the verge of something big here in this space. At the very least, having the ability to verify a piece of physical art on the blockchain recognizing you as the creator would be extremely beneficial to brick-and-mortar art galleries in the future. It would seem that it should accompany every purchase of a tangible good to declare a record of incorruptible ownership.

TL;DR – Tokenization encourages future content creation

- Video Streaming will be faster, and Content Creators will have more skin in the game

- Online P2P File Storage will be cheaper, faster, and safer

- Alternative types of advertising and crypto “tipping” will help content creators push out more work and get paid for it

- Crypto art is ushering in a new era of creative artists profiting from work that is near and dear to them

With my fingers cramping up from typing, I think I’ll end on this note. This article isn’t meant to be the end-all-be-all. It is just meant to share some thoughts with you and encourage some discourse on this subject. Digital content is already easy to consume. The next step is to make it more rewarding for the creators.

With big companies pouring billions into the Crypto-sphere, I can honestly say that I doubt it will go away now. Nor should it.

The biggest question will be which Crypto tokens will be around in 10-20 years and how they can change industries to allow for more creativity and freedom.